How Far Back Can Comps Be for a Mortgage

Reverse Mortgage Line of Credit

In 2021, the reverse mortgage line of credit continues to be the most popular option for homeowners when choosing how to access their funds.

According to an article by AARP, borrowers recognized this choice at about 66% of the time when obtaining a reverse mortgage as being the right choice for them.

The credit line option allows borrowers a great deal of freedom when planning their finances.

Homeowners like the fact that they can take as much as they want when the loan originally closes up to the maximum allowed by HUD in the first 12 months and then can take the funds as needed from there.

Borrowers appreciate that while they can take all remaining available funds after 12 months, they are not required to take any funds they don't want or need.

But since the credit line reverse mortgage is only available in an adjustable rate, many may wonder why this option is even more popular than the fixed rate program.

The answer is flexibility.

Fixed Rate Products Offer Lump Sum Only

The fixed rate reverse mortgageoption has only one way you can take your funds and that is all in a lump sum at the very beginning.

The fixed rate does not have a line of credit option, it is a single draw that must be taken in full when the loan closes.

This option is fine if you need all the funds at the start, for example to pay off an existing mortgage or for other purposes.

However, if you want to be able to access your funds as you go, the fixed rate option will not work.

The credit line gives the borrowers the option of taking as much money as they wish at initial funding, but then with the remaining funds the borrowers can access the funds as they desire.

But there are other benefits to the line of credit reverse mortgage as well.

For one, the borrower does not accrue interest on any portion of the funds that are not being used.

Federally Insured LOC = Greater Security

Borrowers who do not have an immediate need for funds do not have to pay interest on the funds if they remain un-borrowed and available to the borrower.

The Home Equity Conversion Mortgage (HECM or "Heck-um") line of credit is the one credit line that can *never be frozen or closed while the borrower still has a remaining balance left on it.

How many people do you know who have had a credit line from their local bank frozen during tough credit times or when home values begin to stabilize or even drop?

It may even have happened to you.

The senior HECM borrower with the credit line option has paid their federal mortgage insurance to insure that their line of credit will always be available to them.

(*You must continue maintaining your taxes, insurance and living in your home as your primary residence)

Growth Rate Feature

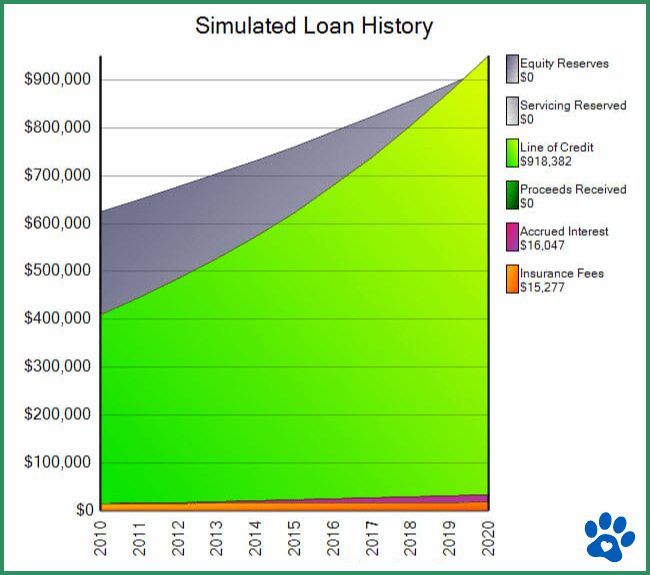

Another extremely important feature of the line of credit reverse mortgage is the credit line growth rate.

I have often heard this mischaracterize as interest earned which it is not, but the unused portion of the credit line grows at the same rate at which the loan accrues interest plus the Mortgage Insurance Premium (MIP) renewal.

Growth Rate Example:

In other words, in today's market if the fully indexed accrual rate (index + margin) is4.25%, and the MIP renewal rate that you would add is + .50% = the interest plus the MIP would total 4.75% for the interest and the mortgage insurance combined.

If the Available Loan Amount of your loan is$350,000 after the net Principal Limit and costs have been determined, and you don't use those funds, then your credit line begins to grow monthly based on the interest rates.

Your line of credit would grow by $1,385.41 ($350,000 X .0475 / 12) in the first month alone and would continue to grow at the same rate but would increase as the balance increased.

It would also go down if some or all the funds were used that month as the growth rate is determined on the unused balance of the funds available.

The next month you start with a higher loan balance, so the line of credit goes up even higher.

After just 5 years of this scenario, these borrowers would have available credit of around$450,000 in their credit line, over $550,000 if they should be lucky enough to be able to leave it there for 10!

And here is a hedge against inflation, as the interest rates rise, the amount the borrowers accrue grows even faster.

Curious how much you may be eligible for? Try ARLO's Line of Credit Calculator

Comparing Reverse Mortgages to a HELOC

Also See: Why a Reverse Mortgage is SMARTER than a HELOC

Reverse Mortgage Line of Credit Traditional Bank HELOC Requires monthly mortgage payments NO YES Becomes balloon after 10 years requiring full repayment NO YES Harder for qualify for fixed income borrowers NO YES Minimum credit score NO YES Rate is typically adjustable YES YES Features a guaranteed growth rate YES NO Prepayment penalty NO NO

So, the bottom line is that the line of credit reverse mortgage shares some of the features of the HELOC.

It is a line of credit that borrowers can use to borrow against the equity in their home and they only accrue interest on the funds they borrow.

Unlike a HELOC, there are no payments due, the loan can never be closed by the lender because they made the arbitrary decision to stop making line of credit loans (borrowers do have to occupy the home, pay taxes and insurance on time and maintain the home in a reasonable manner) and the amount available to borrowers grows over time based on a growth rate of the unused portion of the line.

We believe for the reasons stated above and, in the summary, below, the reverse mortgage is a much better long term planning tool for most senior borrowers.

Line of Credit FAQs

What is a HECM line of credit?

The HECM line of credit is one of 4 payment options available on the federally insured Home Equity Conversion Mortgage. The reverse mortgage line of credit is guaranteed for your lifetime and is revolving, allowing for you to repay the balance at any time without penalty. You can make repayments or choose to defer interest out until you later sell your home.

Which is better a home equity line of credit or reverse mortgage?

The answer depends entirely on your individual needs. A home equity line of credit commonly called a HELOC is a short-term interest only loan you can apply for at most major banks. These equity loans are better suited for those who are equipped to making monthly repayments and understand these loans recast after 10 years into a balloon note. A reverse mortgage line of credit is a federally insured program called the HECM and is guaranteed for your lifetime. The HECM line of credit can never be frozen and features a unique growth feature. The reverse mortgage requires no minimum monthly payments and as such comes with relaxed income and credit qualifications for retirees.

How does a reverse mortgage line of credit grow?

A unique feature of the HECM line of credit comes with a guaranteed growth rate. Each month your unused portion of the line of credit will grow at the same interest charges that are applied to your outstanding loan balance.

Growth rate example: If you have borrowed $25,000 against an available $100,000 line of credit, the servicer will charge you interest on the $25,000 but also increase your remaining $75,000 line of credit by the same rate. If the present rate is 4% you will see growth on your $75,000 line of credit the next month at approximately $250.00/$3,000 annually.

Can you get a Home Equity Line of Credit (HELOC) if you already have a reverse mortgage?

Yes and No. The federally insured HECM will allow for subordinate financing. However, it is difficult to find a lending institution that would go behind a reverse mortgage due to the reverse mortgage negative amortization.

How is the interest charged on a reverse mortgage line of credit?

The most common rate is a 12-month annual libor index. Your interest charges will adjust every 12 months to the present index value plus the lenders margin.

Summary:

- The line of credit option has become the most popular reverse mortgage payment plan for most borrowers due to its flexibility.

- Just like a Bank HELOC (Home Equity Line of Credit), you only accrue interest on your outstanding loan balance (not the total amount available to you if you haven't used all available funds).

- The reverse mortgage line of credit is ideal for retirees on fixed income due to easier qualification and no call date or scheduled repayment period with increasing payments.

- Funds available in your credit line increase or grow if you still have funds remaining each month giving you more money to use, this is called the "growth rate".

ARLO recommends these helpful resources:

- Reverse Mortgage Types: Lump Sum Payout -VS- Line of Credit

- Skip the Reverse Mortgage Tenure and Go For Growth!

America's #1 Rated Reverse Lender Celebrating 17 Years of Excellence.

How Far Back Can Comps Be for a Mortgage

Source: https://reverse.mortgage/line-of-credit

0 Response to "How Far Back Can Comps Be for a Mortgage"

Post a Comment